Uncovering Potential Transshipments with Path Search

Explore the capabilities of Altana in screening for fines related to anti-dumping or countervailing duties. This tutorial demonstrates how to use Altana to trace the origins of goods and their potential connections, with the alleged transshipment of cabinets from China through Vietnam into the U.S. by BGI Group serving as an example.

Using Path Search to Identify Point of Origin

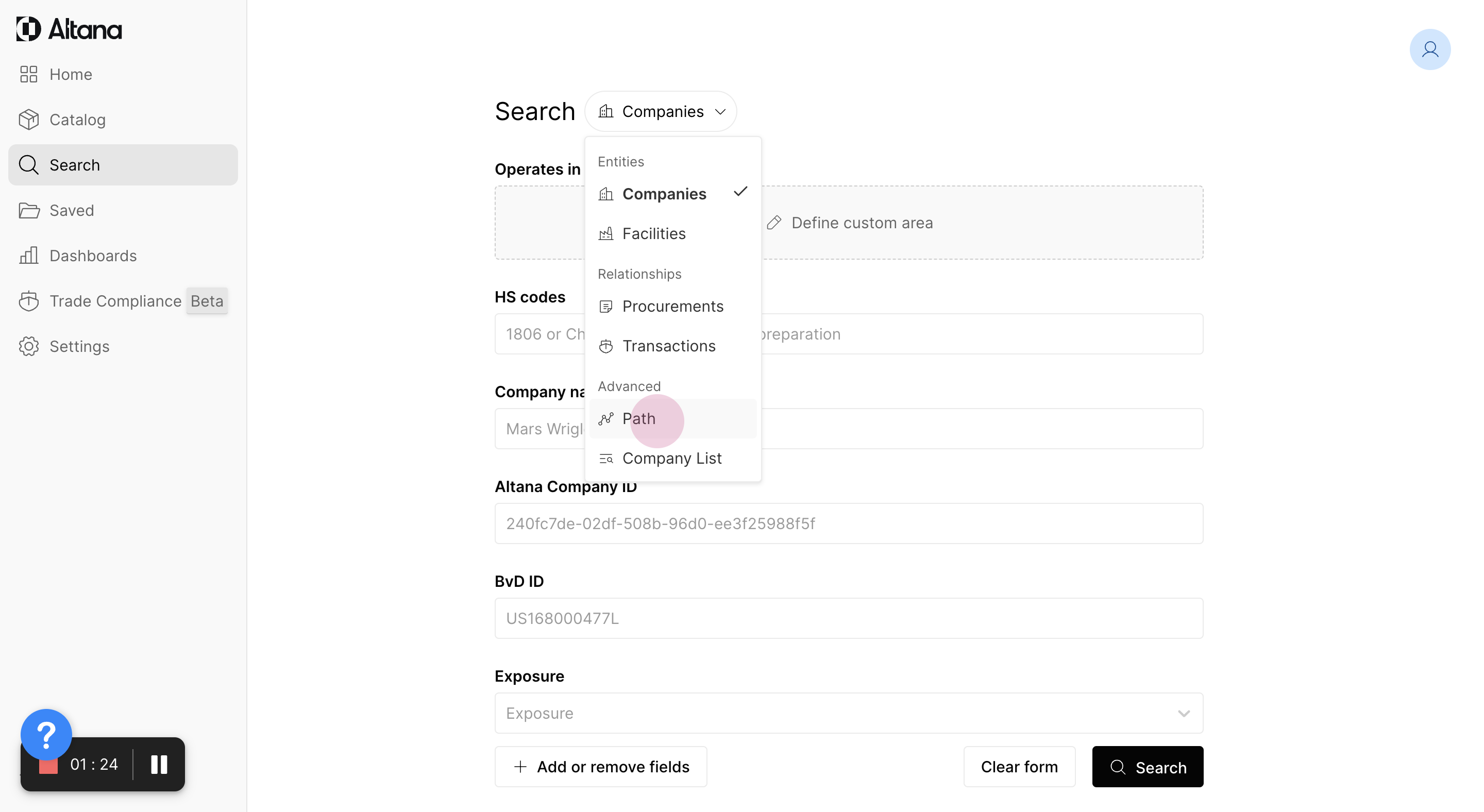

Step 1: Launch path search. This tool identifies the shortest path from a point of origin to a target destination, even when intermediary stops or entities are involved within two degrees of separation.

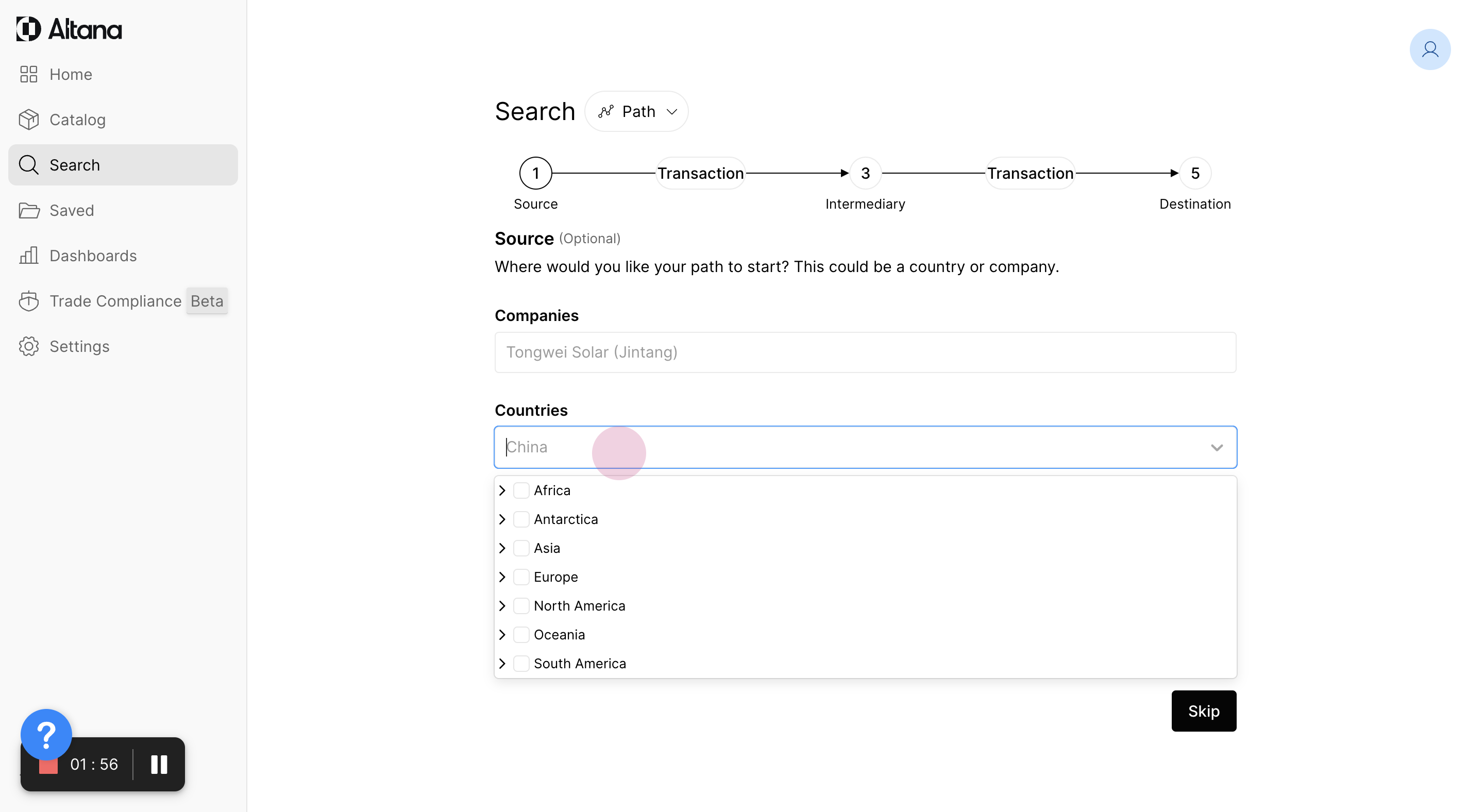

Step 2: Determine the source or point of origin. In this example, set China as the country of origin.

Inputting Transaction Details

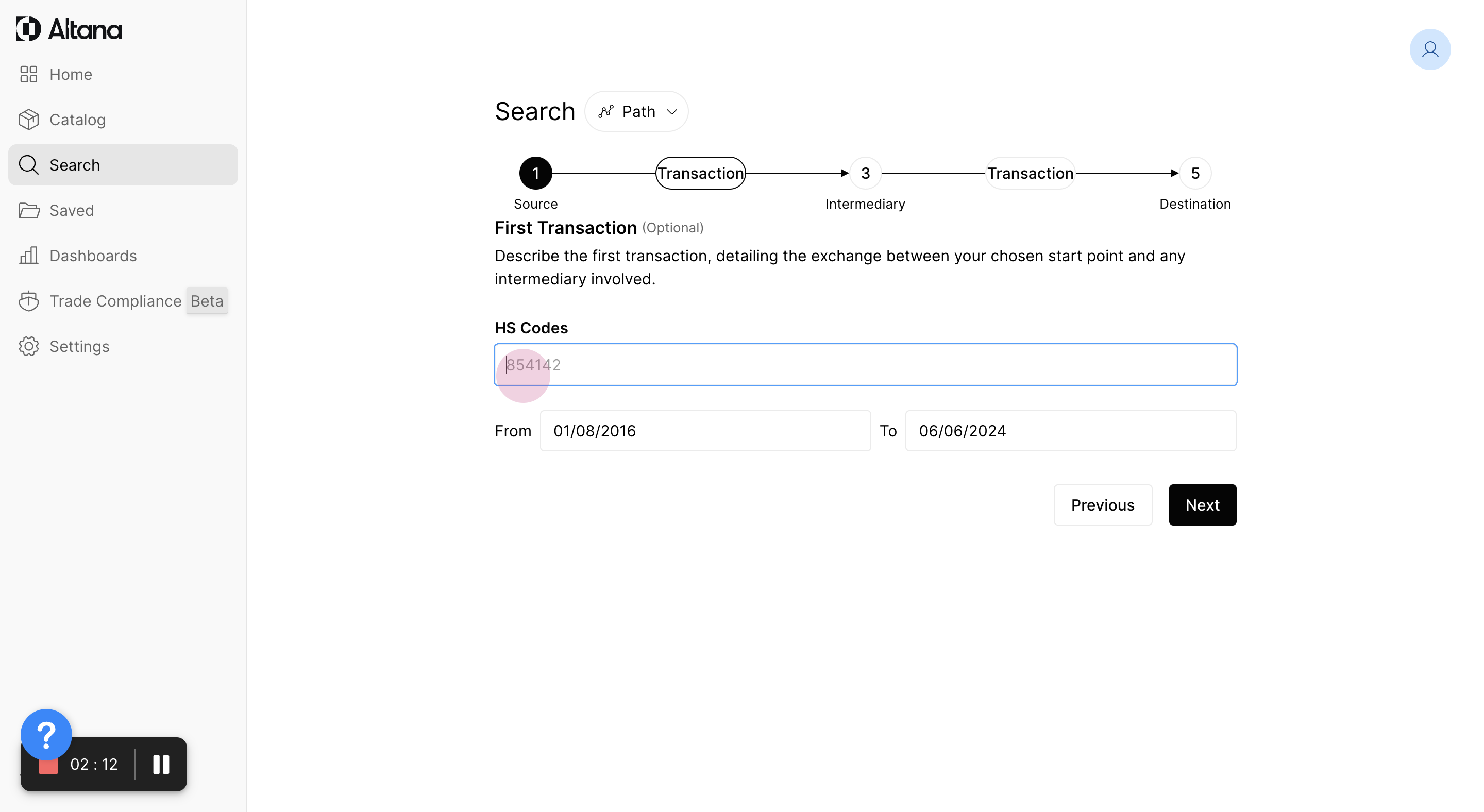

Step 1: Input specific transaction details, such as the HS code for kitchen cabinets (940390), to narrow down the search.

Step 2: Select a date range, starting from the earliest transactions in 2016 up to the present day. After this, hit Next.

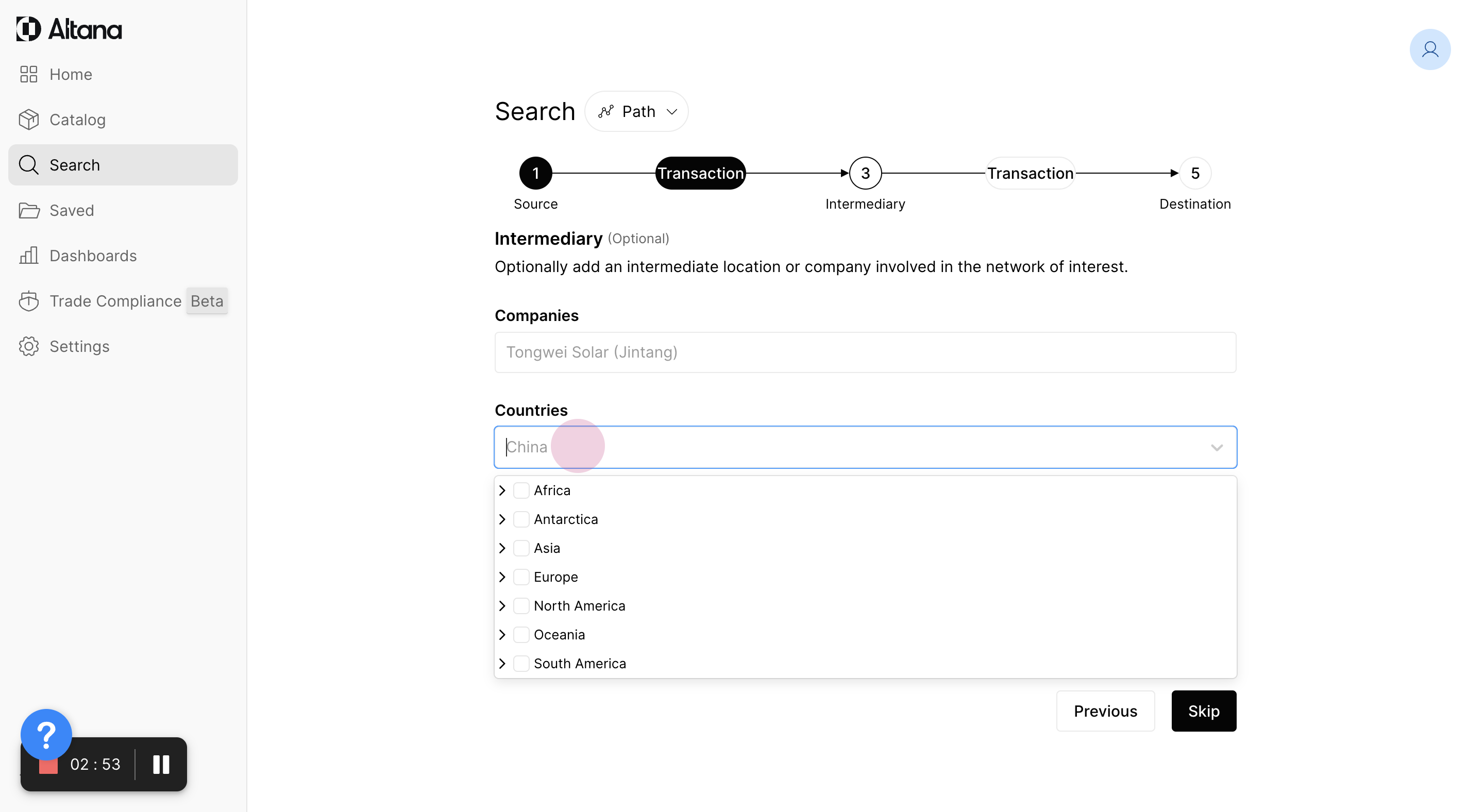

Step 3: Include the intermediary country through which the goods might be transshipped. In this scenario, set Vietnam as that country.

Examining Shipment Transactions

Step 1: Review the second leg of the shipment transactions. Choose the same HS code, indicating that the same materials are being shipped from China to Vietnam, and then from Vietnam to the U.S. without any significant change or substantial transformation in the product. Maintain the same date range and hit Next.

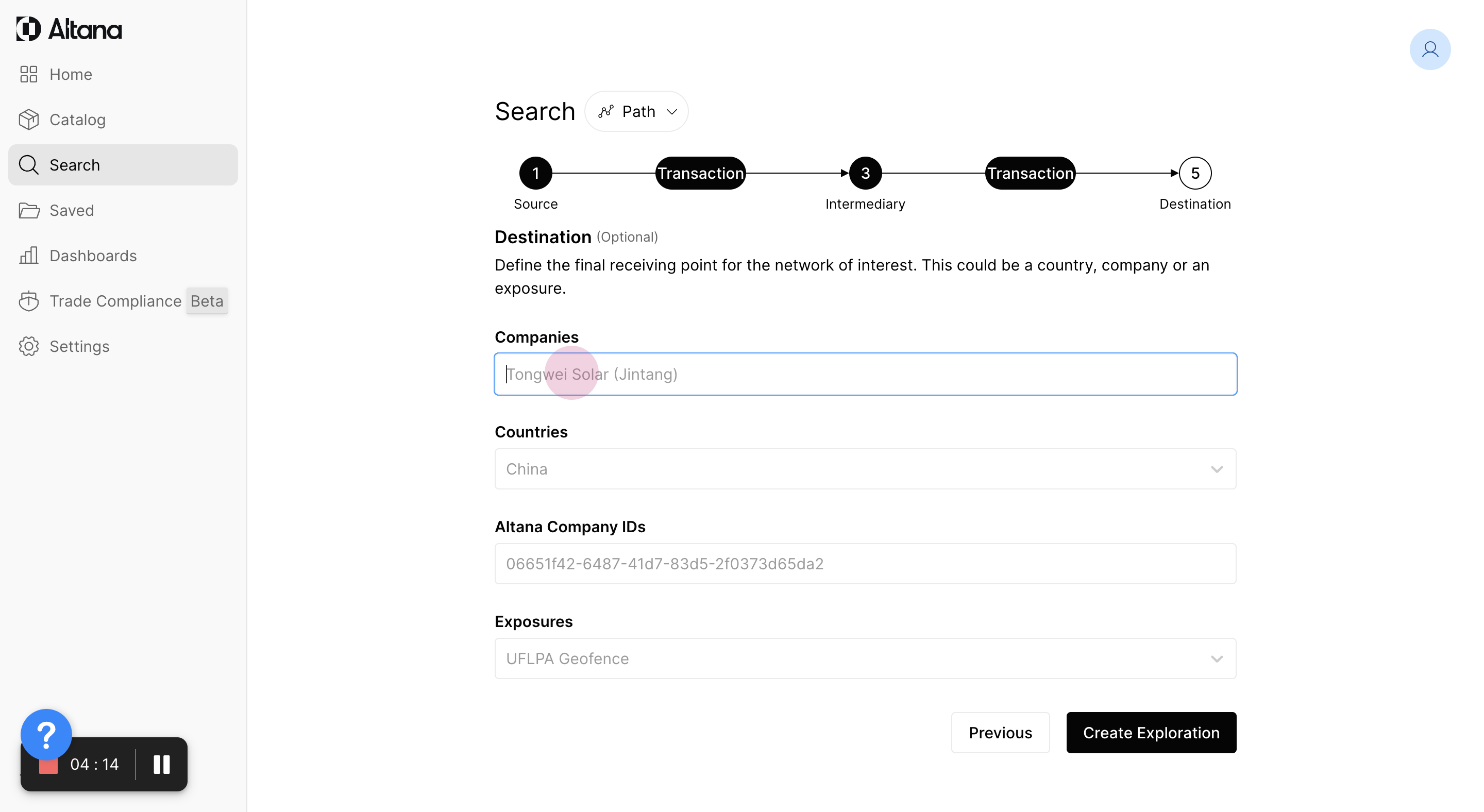

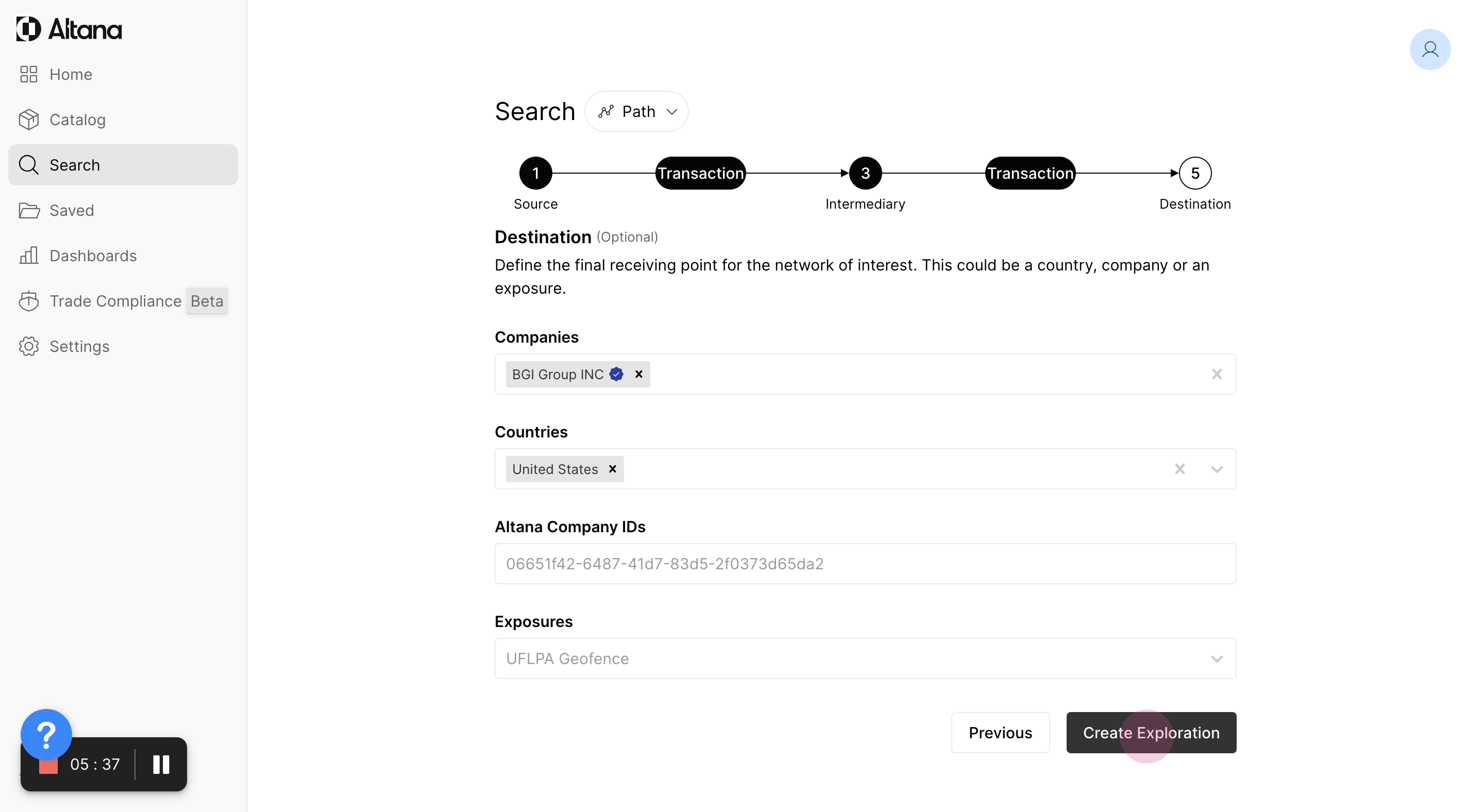

Step 2: For the target destination, input the name of the company under investigation, which has received the goods as the importer record into the U.S. In this case, the company is BGI Group Inc. Enter the destination country and the destination company name for further tracking and analysis. For the exploration, set the destination country as the United States. Input specific company IDs associated with each step of the process for more precise selection and creation of exploration parameters.

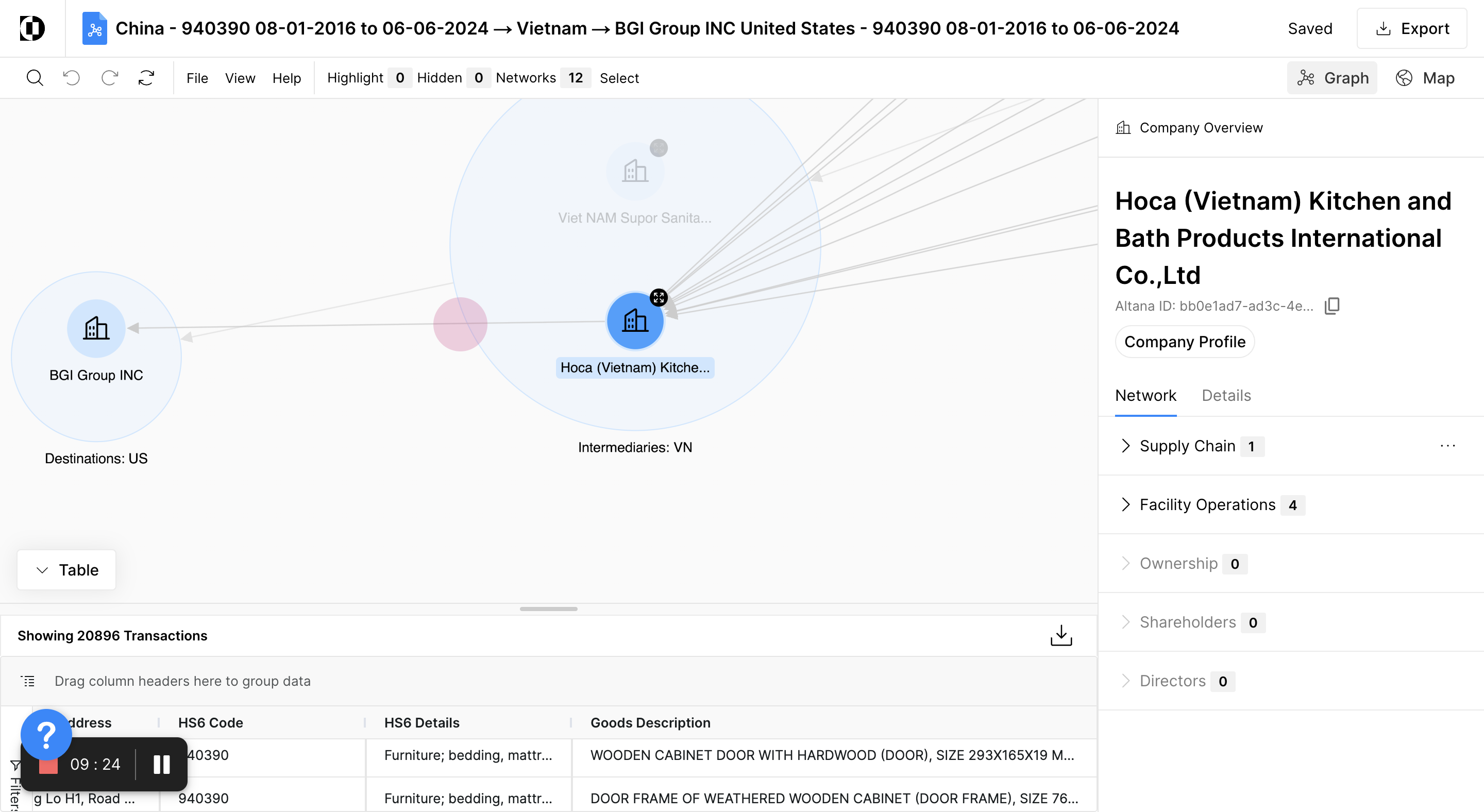

Visualizing the Flow of Goods

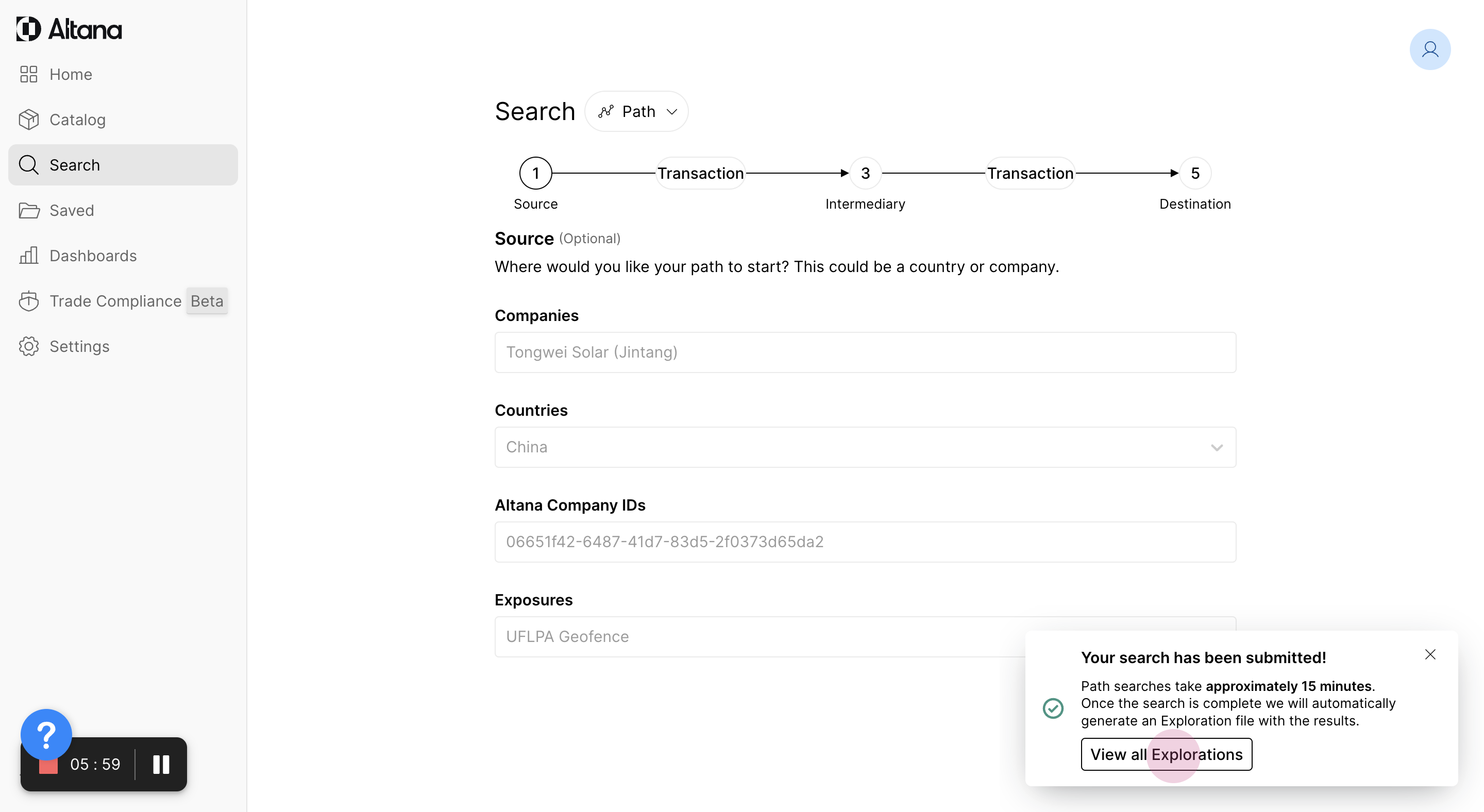

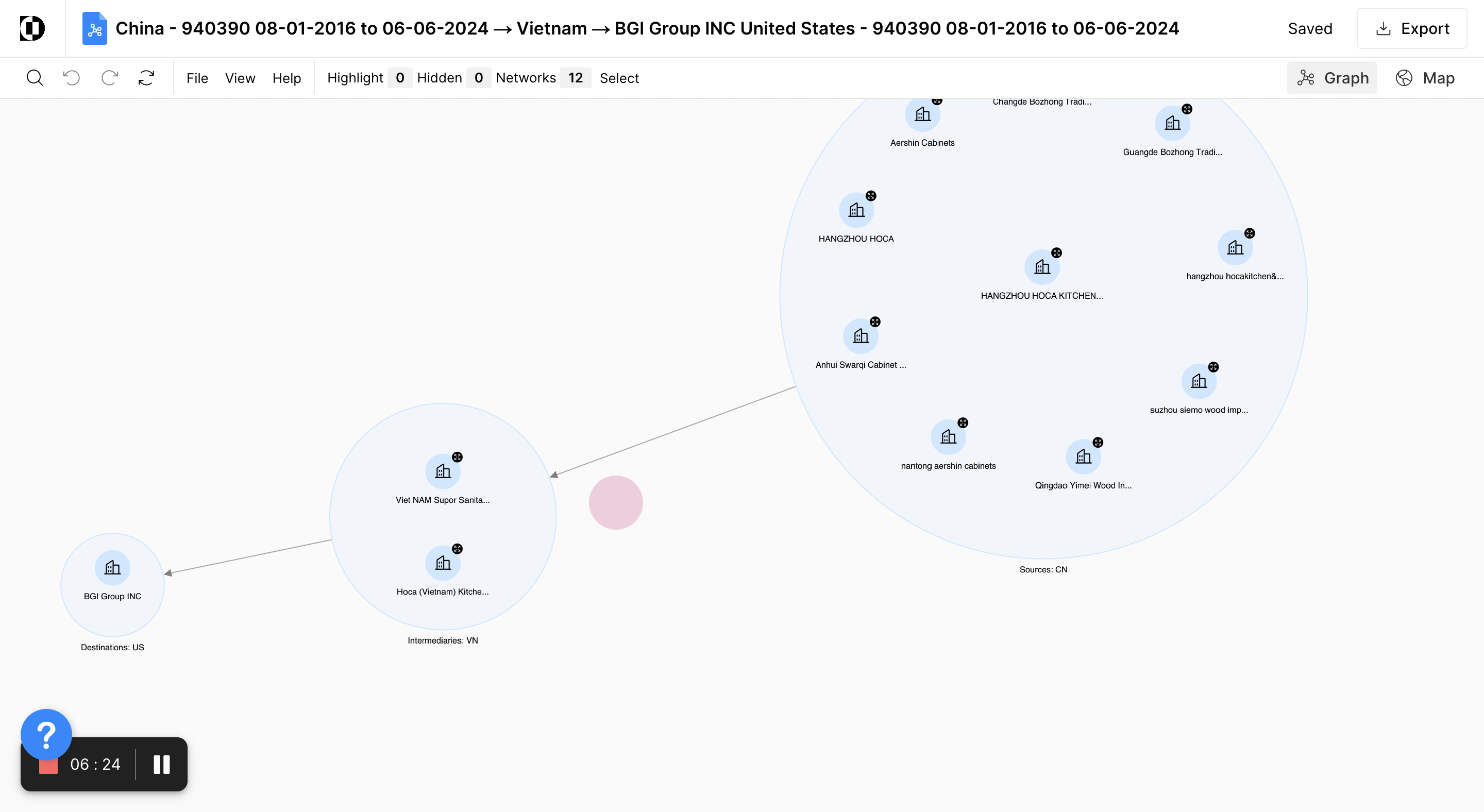

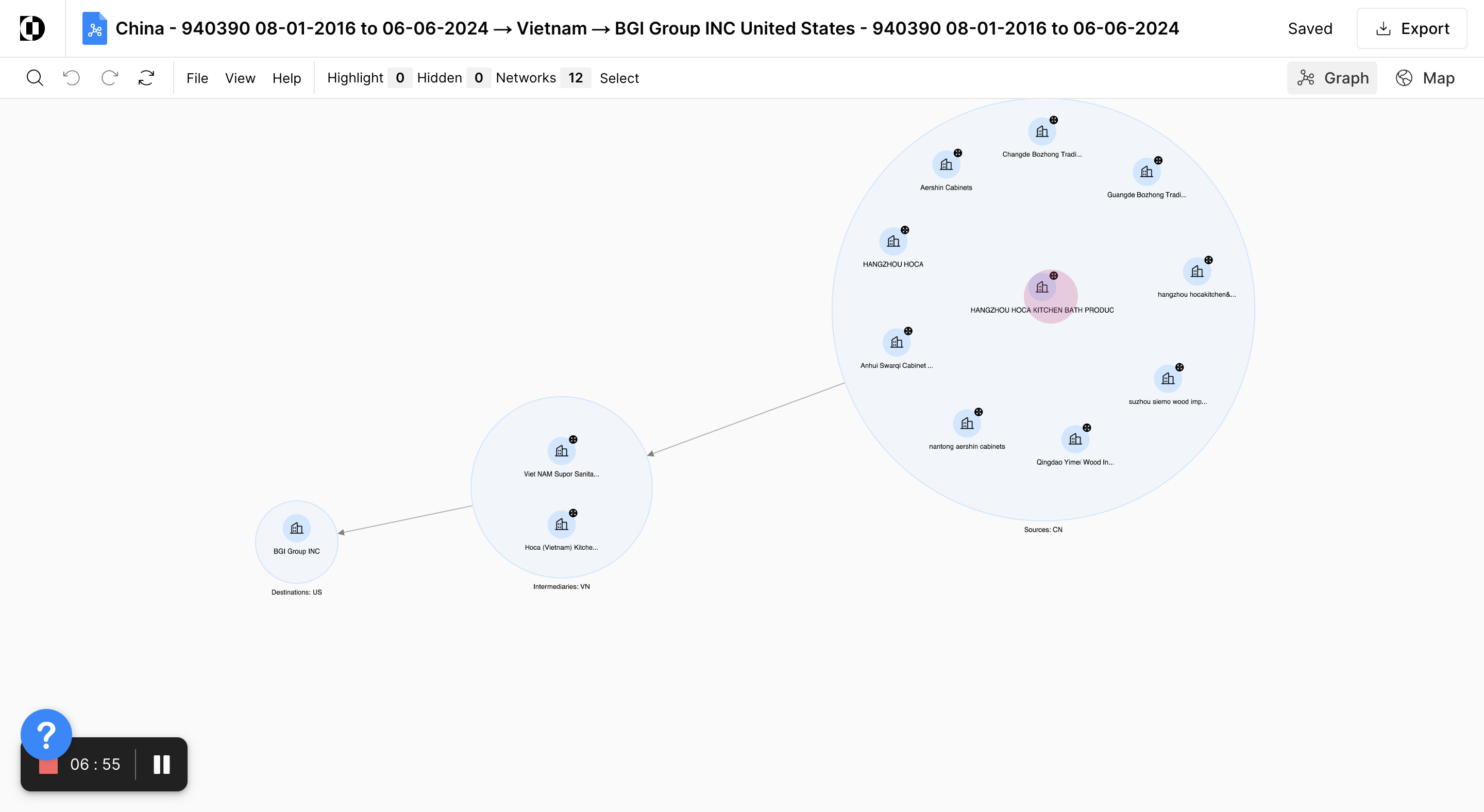

Step 1: Go to saved explorations, now fully loaded, and select the most recent exploration. This exploration shows all the companies included within the search parameters.

Step 2: Examine the visualization showing all companies in China that are shipping goods with the same HS code to intermediary companies in Vietnam, which are then imported into the United States with BGI Group Inc. as the importer of record.

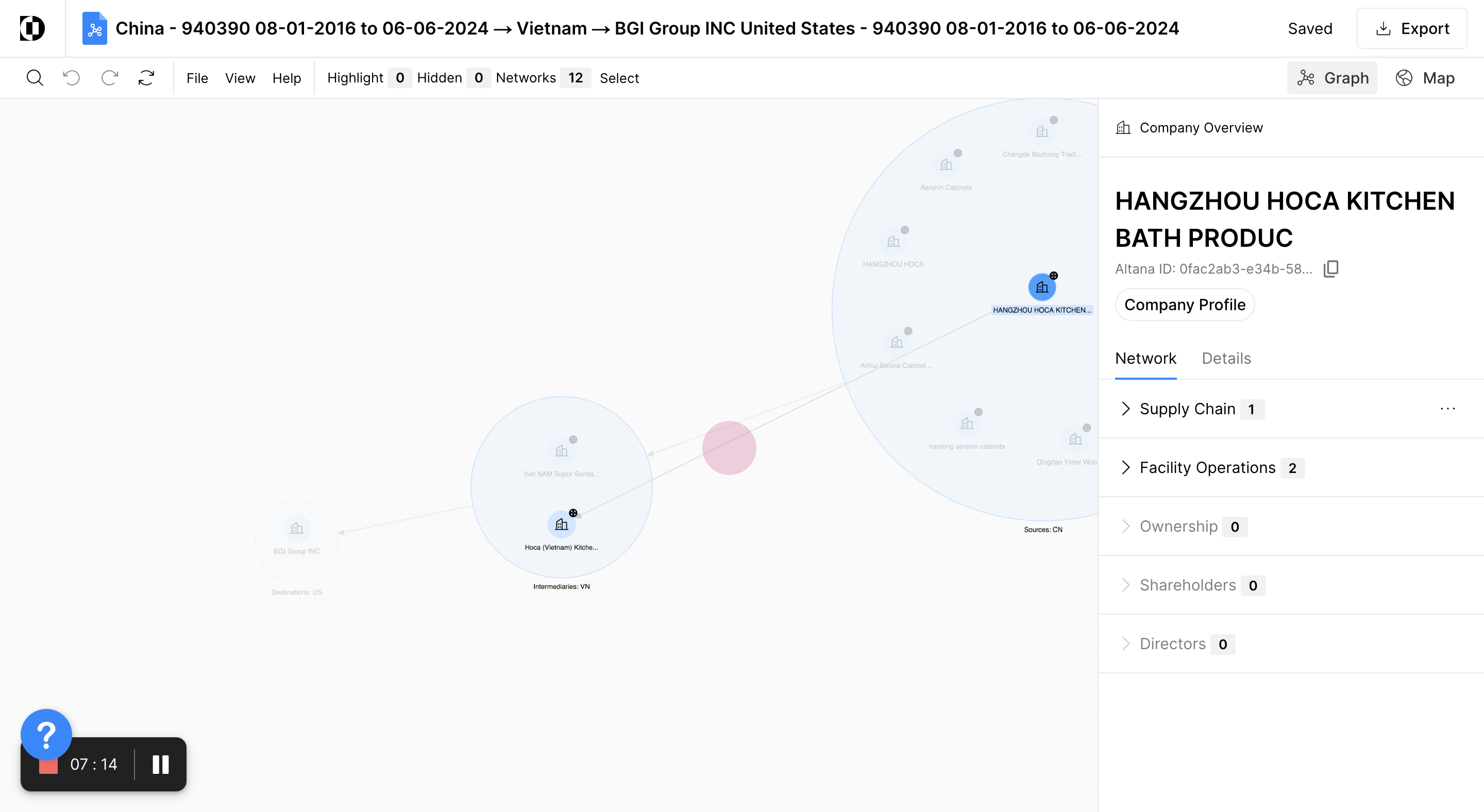

Step 3: Choose a specific company in China, identified as Hangzhou Hoca Kitchen Bath Products.

Step 4: Select the transaction edge that connects it to companies in Vietnam, specifically looking at shipments from Hangzhou Hoca to Hoca Vietnam Kitchen.

Reviewing Shipment Transactions

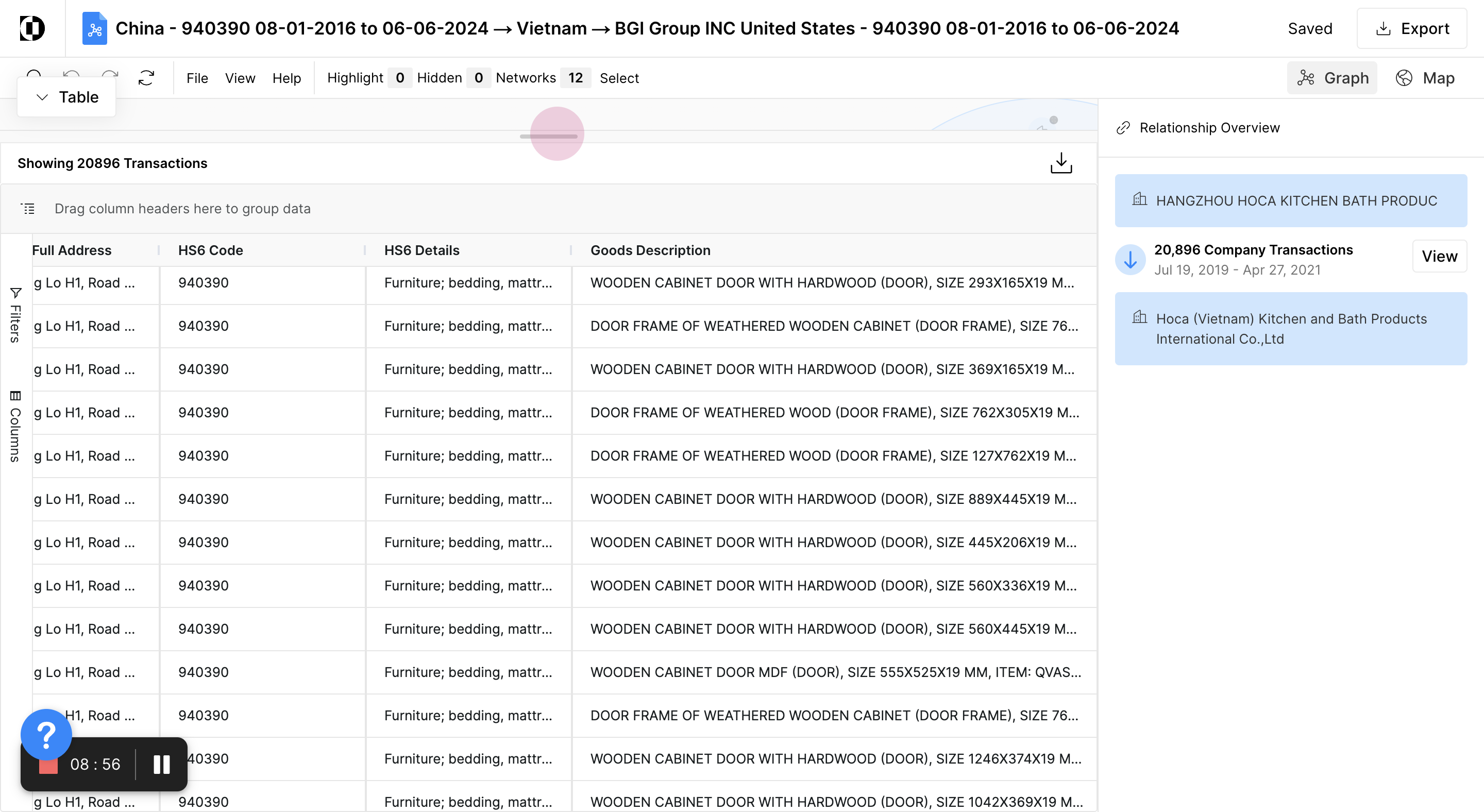

Step 1: Examine the shipment transaction information derived from manifest bills of lading and other logistic documents. This data includes the Harmonized System (HS) codes and detailed descriptions of the goods being shipped. The goods in question include kitchen cabinets among other items. These include wooden cabinet doors, which are being shipped from China to Vietnam.

Analyzing Subsequent Shipments

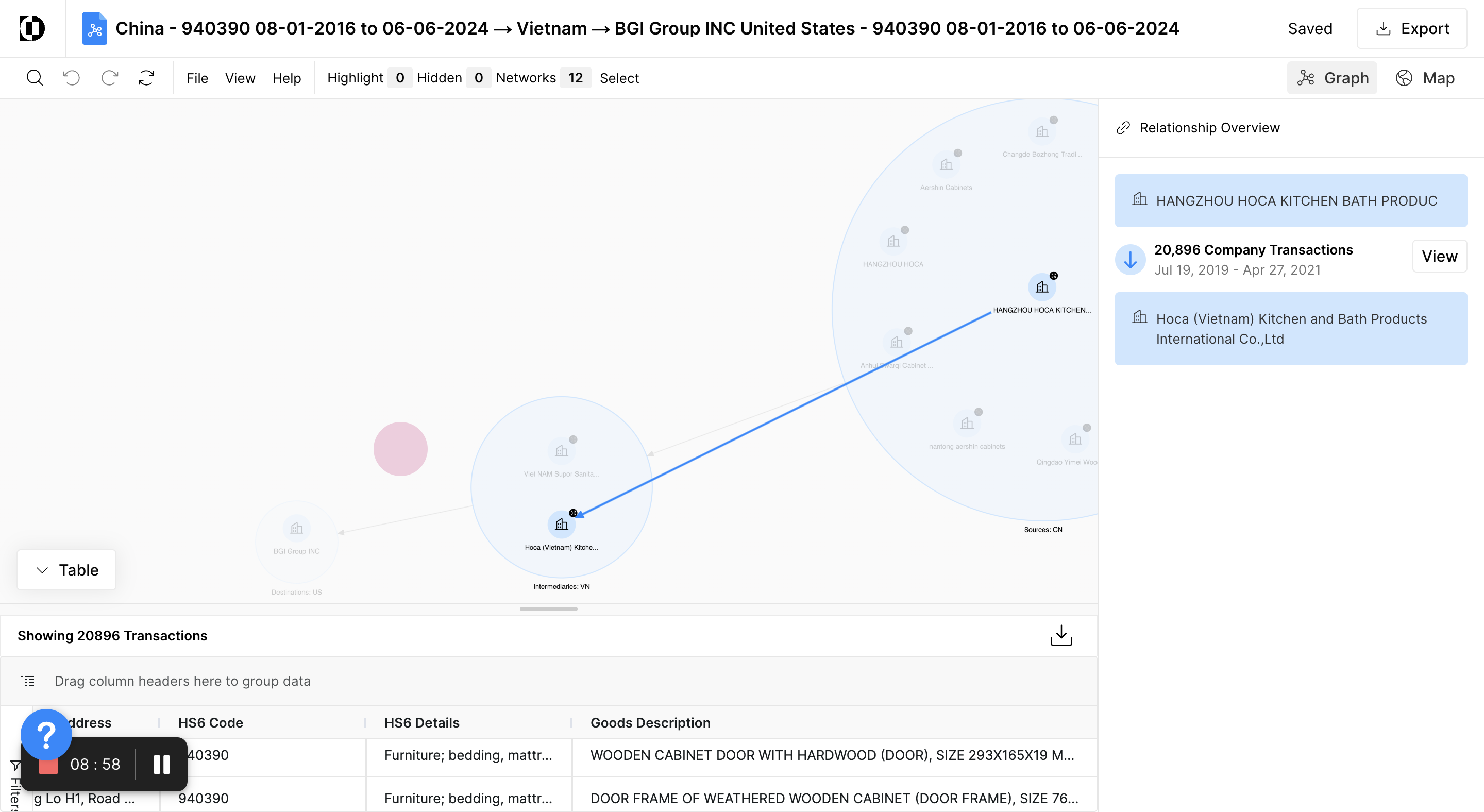

Step 1: Direct further analysis towards the subsequent leg of the shipments, specifically from Hoca Vietnam to BGI Group in the United States. Select Hoca Vietnam to examine the inputs received from China.

Step 2: Observe that these inputs consist of finished goods related to kitchen cabinets, categorized under a specific HS code, in a very high volume. One of the Chinese exporters shipped over twenty thousand units.

Step 3: Examine the transactions between Hoca Vietnam and BGI Group by selecting this specific transaction edge, revealing a significant volume of nearly six thousand shipments.

Step 5: Note the timeframe for these transactions, which aligns with the previous shipments received by the related Hoca entity located in China. This temporal alignment across different legs of the supply chain underscores the potential that Hoca Vietnam is receiving finished products from China and repackaging them in Vietnam before exporting to the U.S.